Thirteen states do not impose a real estate transfer tax. The county recorder technically doesn’t care who files the fee, as long as it’s paid when the paperwork is filed, the company says. Real estate transfer tax is something both parties can negotiate, much like other fees in a real estate transaction, Viva Escrow adds. (Illinois Realtors, a trade association that represents the state’s real estate practitioners, has a chart of Illinois real estate transfer taxes listed by municipality, so you can see the variations in just one area.) In Chicago, Illinois, for example, the buyer pays $7.50 per $1,000 of the net sale while the seller pays $3 per $1,000 - a total of $10 per $1,000 of each sale, according to Craig Fallico, a veteran real estate agent serving the Chicago suburbs. Sometimes the buyer pays this tax, sometimes the seller does, and sometimes a buyer and seller split the cost. But the municipality decides who pays what.

In the above example, the seller is on the hook for paying real estate transfer tax. Who pays transfer taxes at closing: the buyer or seller? What’s more, some states charge additional transfer taxes based on an area’s population or vary the rate depending on whether the property being transferred is residential or agricultural, MidPoint notes. No wonder your real estate agent needs a calculator handy! So if you sold a Santa Monica beach property for $2 million, you’d owe $2,200 to Los Angeles County and $6,000 to the City of Santa Monica - a total of $8,200 in what the state calls “documentary transfer tax.” San Francisco charges varying fees based on the net sale price ranging from 0.5% for property up to $250,000 and 3.0% for property that nets more than $25 million, according to Viva Escrow, an escrow firm in Monrovia, California. In Los Angeles County, for instance, five cities charge an additional fee: $4.50 per $1,000 for Los Angeles and Culver City $3 per $1,000 for Santa Monica $2.20 for Pomona and Redondo Beach. Municipalities also have the ability to levy additional transfer taxes.

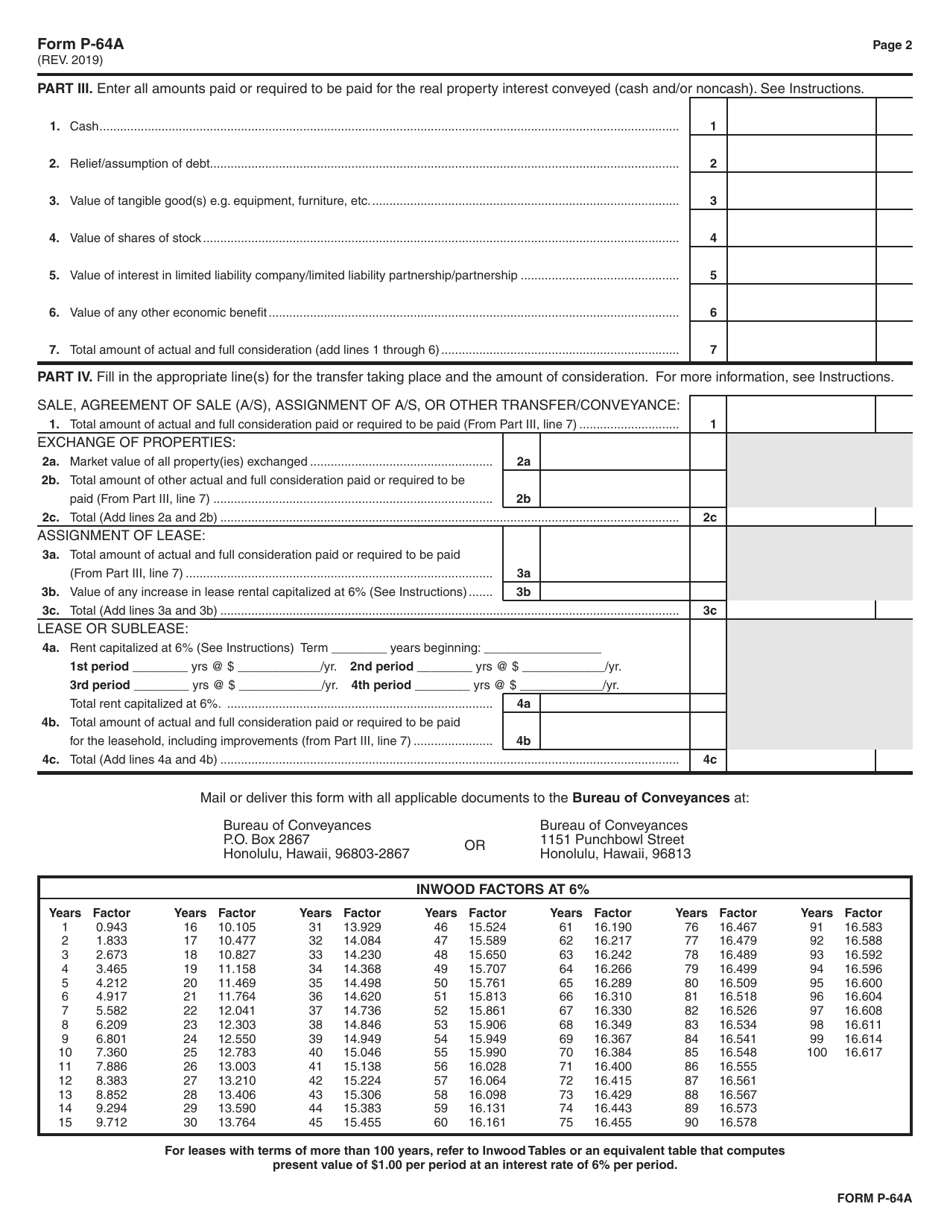

HAWAII CONVEYANCE TAX ON COMMERCIAL CODE

California’s Revenue and Taxation Code charges $1.10 per $1,000 of the transferred net value, or 55 cents per $500, Wasserman says. Most fees range from under a dollar per $100 or $500 to roughly $1 to $3 per $1,000 of the transferred net value. (Wasserman describes that as exclusive of any liens.) Arizona charges a flat fee of $2 while West Virginia charges $50, according to MidPoint, a National Title Company based in Cedar Park, Texas. Source: (Pascal Bernardon / Unsplash) What are real estate transfer taxes?Ī real estate transfer tax is a fee you pay to a state, county, or municipality for “ the privilege of transferring real property within the jurisdiction,” according to Investopedia, a financial information website since 1999.ĭepending on where you live, the tax can be a flat fee or an amount specified per every $100, $500, or $1,000 of the transferred property value. Once you’ve got a firm foundation, consult our comprehensive chart with a list of the transfer tax rates for all 50 states. “When you have cities and states that have lots of services that they provide, they have to raise that revenue somehow.”įirst we’ll take a look at this particular line item in your closing costs in the hope that better understanding this fee makes it less mentally taxing. “In California, it’s a fact of life,” says Brett Wasserman, an associate attorney who handles real estate law at the legal offices of Marc Bronstein in Santa Monica, California. Ultimately, the purpose of this tax is the same as others: to generate revenue for your state, county, or city (and sometimes all three). So even though you’re the one getting a big check, you’ll also receive a closing statement that lists out all of the charges you owe (how fun, right?) One little fee tacked onto your final settlement is the real estate transfer tax, also known as a deed transfer tax, stamp tax, conveyance tax, or a documentary transfer tax - and it’s not one many sellers instantly recognize. HomeLight always encourages you to reach out to an advisor regarding your own situation. DISCLAIMER: This article is meant for educational purposes only and is not intended to be construed as financial, tax, or legal advice.

0 kommentar(er)

0 kommentar(er)